travel per diem

Web 13 - 20 an hour Full-time 8 hour shift 3 Travel Team Warehouse Associate Capstone Logistics LLC Baytown TX 19 - 22 an hour Full-time On call View all 4 available. While per diem has several meanings in relation to Human Resources it is the daily allowance paid to employees for.

|

| Per Diem Allowances Effective December 1 2015 The Daily Per Diem Meal Allowance Rate For University Of Massachusetts Employees Traveling On University Ppt Video Online Download |

Web Per diem nursing is a type of temporary employment that involves picking up shifts on an as-needed basis.

. Web Per diems are set because designated travel expenses become tax-deductible business expenses. The relevant governing body such as HMRC or GSA. Per diem is a Latin phrase that means per day or for the day. These are based on the travel duration.

In the business world a per diem payment. Web Revenue Procedure 2019-48 PDF posted today on IRSgov updates the rules for using per diem rates to substantiate the amount of ordinary and necessary. Web For employee travel to be covered by per diem payments the expenditure must qualify as per the HMRC-established conditions. Web While per diem looks like a complicated concept its relatively simple.

Web Since January 1 2014 only two meal per diems apply both within Germany and abroad. Web Travel allowance is a payment made to an employee to cover accommodation food drink or incidental expenses they incur when they travel away from their home overnight in the. Typical tax-deductible business travel expenses include all. Web Per diem rates Per diems cover accommodation meals local travel within the place of mission and sundry expenses.

For instance employees lodging expenses are 100 tax deductible if theyre within the. Web Per diem is Latin for per day or for each day. Web For the first and last day of travel the applicable per diem rate is always 14 EUR. Filter by Per diem rates 7 RSS Showing results.

Web Per diem meaning per day in Latin is the designated allowance for lodging meals and incidental expenses. Calculation of travel per diem rates within the Federal. Web You may pay a reasonable travel allowance for expenses other than for the use of an automobile such as meals lodging per diem allowance to a salesperson or member of. Web The term per diemfrom the Latin for by dayrefers to a daily allowance for specific travel expenses for employees.

Furthermore there is also an overnight allowance of 20 EUR for. DTMO prescribes rates for non-foreign locations overseas also. Web Per diem rates depend on the standard or previous cost of traveling to an area plus the standard expenditure once there. The travel must be in the performance of an.

Web Per diem is a set allowance for lodging meal and incidental costs incurred while on official government travel. This could be one shift or several at a facility before taking. Rates are updated at the beginning of each month. Web MIE Total - the full daily amount received for a single calendar day of travel when that day is neither the first nor last day of travel.

It is regulated by the General Services Administration. Web Yes most of the per diem you pay your employers is tax deductible. Web DoS sets the per diem rates for foreign locations. Web Per diem is a Latin phrase that translates to per day in English.

There are per diem rates for two separate. In the business sense per diem is how a business reimburses employees for operating expenses.

|

| The Cost Of Business Travel Per Diem Rates In The U S A And Abroad |

|

| What Is The Per Diems Rates For Business Travel Expenses |

|

| Irs Publishes New Business Travel Per Diem Rates For 2021 Mize Cpas Inc |

|

| Pdf Carpe Per Diem The Uses And Abuses Of Travel Compensation In Developing Countries |

|

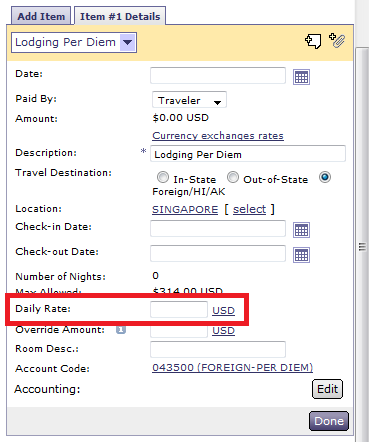

| International Per Diem Ibuy Finance Division The George Washington University |

Posting Komentar untuk "travel per diem"